American express gold card benefits – The American Express Gold Card offers a plethora of enticing benefits, catering to discerning individuals seeking elevated experiences in travel, dining, shopping, and beyond. This exclusive card grants access to a world of rewards and privileges, transforming everyday moments into extraordinary adventures.

From complimentary airport lounge access to exclusive dining events, the American Express Gold Card is a passport to a life well-lived. Its comprehensive suite of benefits empowers cardholders to indulge in their passions, enjoy peace of mind, and elevate their lifestyles.

Introduction: American Express Gold Card Benefits

The American Express Gold Card is a premium credit card that offers a range of benefits and rewards to its cardholders. It is designed for individuals who value dining, travel, and entertainment experiences and are willing to pay an annual fee in exchange for these benefits.

This article aims to analyze the benefits of the American Express Gold Card and determine whether it is a worthwhile investment for potential cardholders.

Travel Benefits

The American Express Gold Card offers a range of travel-related benefits that can enhance your travel experiences and provide peace of mind.

These benefits include access to airport lounges, complimentary hotel upgrades, and comprehensive travel insurance.

Airport Lounge Access

- Complimentary access to over 1,200 airport lounges worldwide through the Priority Pass network.

- Lounges offer amenities such as comfortable seating, Wi-Fi, snacks, and beverages.

- Access to lounges can help you relax and refresh during layovers or delays.

Complimentary Hotel Upgrades

- Eligible for complimentary upgrades at select hotel chains, including Hilton, Marriott, and Four Seasons.

- Upgrades may include larger rooms, better views, or access to exclusive amenities.

- Hotel upgrades can enhance your stay and make your travels more enjoyable.

Travel Insurance

- Comprehensive travel insurance coverage, including trip cancellation, interruption, and delay.

- Insurance also covers lost or stolen luggage, medical expenses, and emergency evacuation.

- Travel insurance provides peace of mind and protects you from unexpected events during your travels.

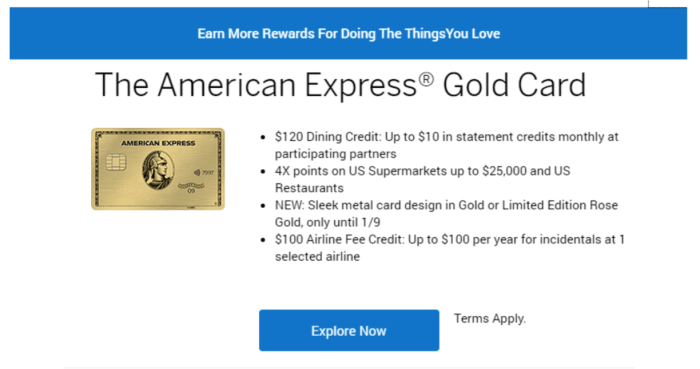

Dining Benefits

Indulge in culinary experiences with the American Express Gold Card, which offers an array of dining-related benefits tailored to satisfy discerning palates.

Through the exclusive American Express Dining Program, cardholders gain access to a curated selection of fine dining establishments, exclusive events, and culinary experiences.

Membership in the American Express Dining Program

- Access to a global network of renowned restaurants and chefs

- Invitations to exclusive dining events, tastings, and cooking classes

- Personalized recommendations and reservations through dedicated concierge service

Exclusive Access to Dining Events, American express gold card benefits

Gold Card members are granted exclusive access to invite-only dining events, offering opportunities to connect with renowned chefs, sample innovative cuisine, and savor memorable culinary experiences.

With the best family vacation spots in mind, you can make the most of your American Express Gold Card benefits. Enjoy exclusive access to airport lounges, complimentary room upgrades, and other perks that will enhance your travel experience. Plus, earn Membership Rewards® points on every purchase, which you can redeem for even more travel rewards.

Statement Credits for Dining Purchases

Earn statement credits on eligible dining purchases at participating restaurants, allowing you to savor culinary delights while accumulating rewards.

With American Express Gold Card benefits, you can indulge in exclusive experiences, including extreme sports vacations. From heart-pounding adventures like skydiving and bungee jumping to adrenaline-fueled activities like white-water rafting and mountain climbing, these vacations offer an unforgettable escape.

And with your Gold Card, you’ll enjoy exclusive perks like complimentary upgrades and discounts on these thrilling experiences.

Shopping Benefits

The American Express Gold Card offers various shopping-related benefits to enhance your shopping experiences and provide peace of mind. These benefits include return protection, purchase protection, and extended warranties.

With return protection, you can enjoy the convenience of returning eligible purchases, even if the store does not accept returns. Purchase protection safeguards your purchases against theft, damage, or loss for up to 90 days from the date of purchase. Additionally, extended warranties extend the manufacturer’s warranty on eligible purchases by up to one year, giving you added peace of mind.

Other Benefits

The American Express Gold Card offers a range of other benefits that enhance convenience and provide peace of mind.

These include:

Concierge Service

Cardholders have access to a 24/7 concierge service that can assist with a variety of tasks, such as:

- Making restaurant reservations

- Purchasing tickets to events

- Arranging travel itineraries

Identity Theft Protection

The card comes with complimentary identity theft protection services, which include:

- Credit monitoring

- Fraud alerts

- Identity restoration assistance

Global Assist Hotline

Cardholders have access to a 24/7 Global Assist Hotline that can provide assistance with:

- Medical emergencies

- Lost or stolen luggage

- Legal referrals

Fees and Eligibility

The American Express Gold Card comes with an annual fee. To be eligible for the card, you must meet certain requirements, such as having a good credit score and a steady income.

The American Express Gold Card offers a range of benefits, including access to exclusive experiences. One such experience is a visit to the stunning Alnwick Castle , a magnificent medieval castle located in Northumberland, England. With your Gold Card, you can enjoy a guided tour of the castle, explore its beautiful gardens, and even take part in a falconry display.

This is just one of the many exclusive experiences available to American Express Gold Card members, making it a valuable card for those who enjoy the finer things in life.

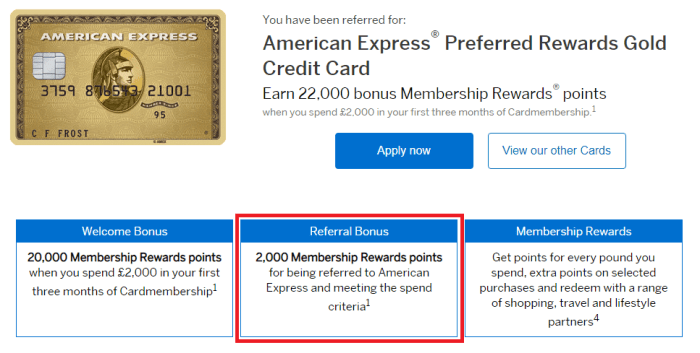

Annual Fee

The annual fee for the American Express Gold Card is $250. This fee is charged once per year, and it is not refundable.

Eligibility Requirements

To be eligible for the American Express Gold Card, you must meet the following requirements:

- Be at least 18 years old

- Have a good credit score

- Have a steady income

- Be a U.S. citizen or permanent resident

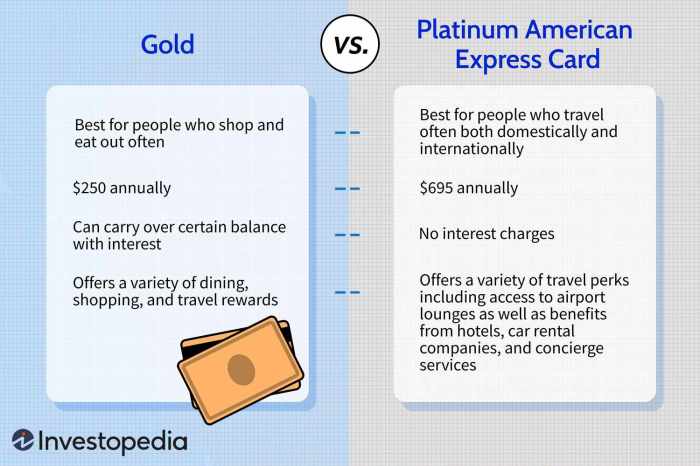

Comparison to Other Cards

The American Express Gold Card offers a range of benefits that compare favorably to those of similar cards from other issuers. These benefits include travel rewards, dining perks, shopping discounts, and other exclusive perks.

To help you make an informed decision, we’ve created a table that compares the benefits of the American Express Gold Card to those of three other popular cards: the Chase Sapphire Preferred Card, the Citi Premier Card, and the Capital One Venture Rewards Credit Card.

Benefits Comparison Table

| Benefit | American Express Gold Card | Chase Sapphire Preferred Card | Citi Premier Card | Capital One Venture Rewards Credit Card |

|---|---|---|---|---|

| Annual Fee | $250 | $95 | $95 | $95 |

| Welcome Bonus | 60,000 Membership Rewards points after spending $4,000 in the first 6 months | 60,000 Ultimate Rewards points after spending $4,000 in the first 3 months | 60,000 ThankYou points after spending $4,000 in the first 3 months | 75,000 Venture Miles after spending $4,000 in the first 3 months |

| Travel Rewards | Earn 4 Membership Rewards points per dollar on dining at restaurants and U.S. supermarkets, and 3 Membership Rewards points per dollar on flights booked directly with airlines or through American Express Travel | Earn 2 Ultimate Rewards points per dollar on travel and dining, and 1 Ultimate Rewards point per dollar on all other purchases | Earn 3 ThankYou points per dollar on travel and dining, and 2 ThankYou points per dollar on all other purchases | Earn 2 Venture Miles per dollar on all purchases |

| Dining Perks | Access to the American Express Global Dining Collection, which offers exclusive benefits at over 1,000 restaurants worldwide | Access to the Chase Dining Rewards program, which offers discounts and rewards at participating restaurants | Access to the Citi Dining Program, which offers discounts and rewards at participating restaurants | Access to the Capital One Dining Rewards program, which offers discounts and rewards at participating restaurants |

| Shopping Benefits | Earn 4 Membership Rewards points per dollar on purchases at select retailers, and 3 Membership Rewards points per dollar on all other purchases | Earn 2 Ultimate Rewards points per dollar on travel and dining, and 1 Ultimate Rewards point per dollar on all other purchases | Earn 3 ThankYou points per dollar on travel and dining, and 2 ThankYou points per dollar on all other purchases | Earn 2 Venture Miles per dollar on all purchases |

| Other Benefits | Access to American Express Experiences, which offers exclusive access to events, concerts, and other experiences | Access to Chase Ultimate Rewards, which allows you to redeem points for travel, cash back, gift cards, and more | Access to Citi ThankYou Rewards, which allows you to redeem points for travel, cash back, gift cards, and more | Access to Capital One Venture Rewards, which allows you to redeem miles for travel, cash back, gift cards, and more |

Conclusion

The American Express Gold Card offers a range of valuable benefits that can enhance your travel, dining, and shopping experiences. If you frequently travel, dine out at restaurants, or make significant purchases, this card can provide substantial rewards and perks. However, the annual fee of $250 should be carefully considered before applying.

Recommendation

The American Express Gold Card is an excellent choice for cardholders who:

- Travel frequently and want to earn Membership Rewards points for flights, hotels, and other travel expenses.

- Dine out regularly and want to take advantage of exclusive dining offers and credits.

- Make significant purchases and want to earn rewards points that can be redeemed for a variety of items.

If you do not travel or dine out frequently, or if you are not interested in earning rewards points, there may be other credit cards that offer better value for your spending habits.

Concluding Remarks

In conclusion, the American Express Gold Card stands as an exceptional choice for individuals seeking a premium card experience. Its unparalleled benefits, coupled with its impeccable reputation and global recognition, make it an invaluable asset for discerning cardholders. Whether you’re a frequent traveler, a culinary enthusiast, or a discerning shopper, the American Express Gold Card offers a gateway to a world of exclusive privileges and unforgettable experiences.

FAQ Section

What is the annual fee for the American Express Gold Card?

The annual fee for the American Express Gold Card is $250.

What is the minimum credit score required to qualify for the American Express Gold Card?

The minimum credit score required to qualify for the American Express Gold Card is generally considered to be 690 or higher.

What are the benefits of the American Express Gold Card?

The American Express Gold Card offers a wide range of benefits, including travel-related benefits such as airport lounge access, complimentary hotel upgrades, and travel insurance; dining benefits such as membership in the American Express Dining Program, exclusive access to dining events, and statement credits for dining purchases; shopping benefits such as return protection, purchase protection, and extended warranties; and other benefits such as concierge service, identity theft protection, and Global Assist Hotline.